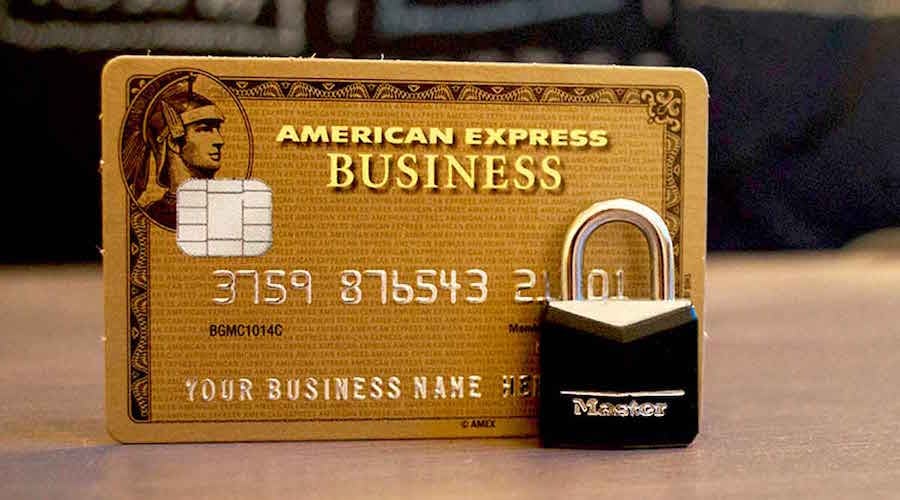

As long as credit cards exist, there will be people trying to use them for fraudulent transactions. And although payment security has become progressively more sophisticated, thanks to the widespread implementation of EMV, criminals are nowhere close to giving up on developing countermeasures. This is why ongoing efforts to prevent credit card fraud at your business are as relevant as ever. Here are a few tips for how you can succeed:

Keep an Eye out for Warning Signs of Fraud

Before we discuss specific fraud prevention tools you can (and should) use at your business, it’s important to note that there are recurring patterns that accompany fraud. For example, fraudulent transactions tend to spike between Thanksgiving and Christmas, since this is when merchants have their hands full and their attention divided.

This happens not only in-store, where a customer may display suspicious behavior such as rushing the cashier during the checkout or refusing a free delivery for large items, but also online, where warning signs like unusually large orders coming from foreign IPs are aplenty.

Use Effective Fraud Prevention Measures

It’s virtually impossible to prevent all fraudulent transactions based on your gut feeling alone. Whether it’s because you’re busy or simply don’t want to accidentally deny a legitimate purchase, you need the help of the right payment technology.

Previously mentioned EMV, for example, is a standard trusted by a large number of businesses both in the U.S. and around the world. Especially now that the long-standing credit card signature requirement has come to an end, chip cards with their encryption and tokenization methods are some of the best ways for you to protect your customer payment data.

And, of course, don't forget to ensure that your business is PCI compliant. This is a crucial factor for all individuals and entities that store, process and/or transmit cardholder data. The consequences of failing to become PCI compliant can range anywhere from a monthly non-compliance fee, by default, to significant financial losses, especially in the event of a data breach.

Stay Up-To-Date on Security Developments

Credit card fraud isn’t expected to decline anytime soon, but it doesn't mean that you shouldn't stay proactive in your attempts to avoid it. It's especially important to pay close attention to payment security developments now, during the holiday season, since you don't want to miss out on valuable sales opportunities. Whether it's effective chargeback prevention, safe online credit card processing or secure mobile payments — make sure you know your options and always use equipment that meets the latest payment processing standards. After all, a one-time investment can go a long way in helping your business run smoothly for years to come.

At TransNational Payments, we hold the safety of your payment processing in the highest regard and aim to provide you with the latest and greatest insights into payment security. See how you can effectively prevent credit card fraud with us!

Facebook

Facebook Twitter

Twitter LinkedIn

LinkedIn Youtube

Youtube Glassdoor

Glassdoor