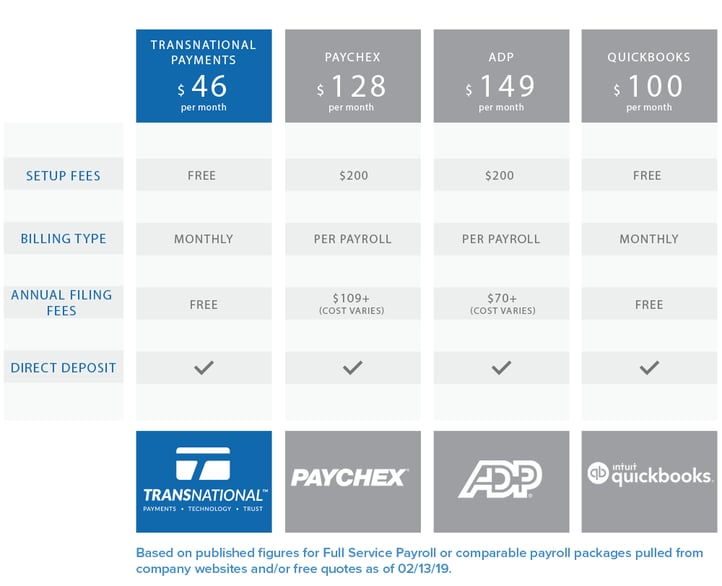

Payroll services for your small business don’t have to cost an arm and a leg, especially when you choose the right payroll company. But when there are so many options out there, where do you begin? Great news! We've gathered the data on some of the most popular payroll companies, and the most expensive full service payroll options by far were ADP, Paychex and QuickBooks Payroll — AKA some of the most commonly used payroll services. So how do these payroll competitors stack up?

First, some background: Full Service Payroll is a reliable, affordable and stress-free solution for small business owners so they can manage their payroll, timekeeping and HR services while the payroll company handles all federal, state and local tax filing year-round.

Even with all of these valuable features and services, there's no reason payroll should be one of your top expenses or time-wasters. When we surveyed payroll companies, the pricing structures and charges varied, but the outcome was the same — there is a dramatic difference in pricing for Full Service Payroll, and the wrong choice could cost you anywhere from $100 to $1,000 in unnecessary spending every year.

Here are the 3 most common costs and fees you need to be aware of when choosing the right Full Service Payroll solution for your small business:

Billing Type: Per Payroll Cost vs. Month-to-Month Plan

Most payroll companies either charge per payroll or offer a monthly subscription plan at a set rate (usually the payroll base cost + per employee cost). As you'll see, if you run multiple payrolls per month, ADP and Paychex aren't cost-effective options for a full service payroll solution.

Look for month-to-month plans with no lengthy contracts or agreements; monthly subscriptions also typically guarantee unlimited payrolls whether you need to run payroll daily, biweekly or monthly.

When you compare the most expensive option, ADP, and the least expensive option, TransNational Payments, there's a difference of $103 per month or $1,240.80 per year!

Ex. When you run a biweekly payroll for 5 employees, it will cost:

We'll calculate your payroll price for free!

Payroll Setup Fees

While many payroll companies don't charge "setup fees," the amount of payroll setup help can vary greatly by provider whether you're charged a fee or not. For example, some companies provide an online setup wizard, video tutorials and setup documentation, but don't offer any live help. Others, like ADP and Paychex, might offer guided setup or transfer your tax history for you — after you pay a couple hundred dollars.

Make sure you understand the level of guidance provided when you're getting started, as well as the technical support that will be available to you and your team. You should never have to pay a fee simply to receive help with technical issues or system errors.

ADP and Paychex: Starts at a $200 one-time charge

TransNational Payments, QuickBooks Payroll, Gusto, Square: None

When you choose TransNational Payments for Full Service Payroll, you can choose to set up your payroll portal one of three FREE ways: 1) Use our self-guided setup wizard online, 2) Request support from our payroll specialists or 3) Choose free setup when you sign up and our payroll team will input all your data for you!

End-of-Year Filing Fees

Some payroll companies say they offer "all-in-one tax filing," but when it's time for employers like you to send and file W-2s, W-3s, 1099s and other required end-of-year tax forms, they charge per form, per employee, or start with a filing base cost to process your yearly taxes. Make sure you're aware of the rates when you're deciding which payroll company you'll partner with!

ADP: End-of-year filing fees are $49.95 base + $3.85 per employee

Paychex: End-of-year and quarterly filing fees; costs vary

TransNational Payments, QuickBooks Payroll, Gusto, Square: None

Conclusion: How Much Do Payroll Services Cost?

It varies! Now you know that if you run multiple payrolls a month, a per-payroll model may not be the most affordable option for your small business. When you're comparing payroll providers, don't forget about the hidden fees that some companies tack on.

In many cases, the price of payroll services for your small business can easily be covered by cutting expenses elsewhere. For example, TransNational Payments can offer complimentary months of payroll or work with you to lower your credit card processing rates, POS system costs or other expenses.

Small business owners report spending 45 minutes to 2.5 hours every week just managing payroll, and up to two full business weeks every year handling federal taxes! Even if you save only half of that time, it's a value to your business (and your peace of mind) that you should invest in.

Easy payroll and hands-free tax filing is one click away!

This article is based on public data and prices quoted from payroll representatives February 2019.

Facebook

Facebook Twitter

Twitter LinkedIn

LinkedIn Youtube

Youtube Glassdoor

Glassdoor